montgomery county al sales tax return

If you are currently setup to Electronically File State of Alabama SalesUse Taxes online step by step instructions for adding Montgomery County to your online filing through the MAT system are also available at revenuealabamagovsales-useone-spot. The local tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales.

Did South Dakota v.

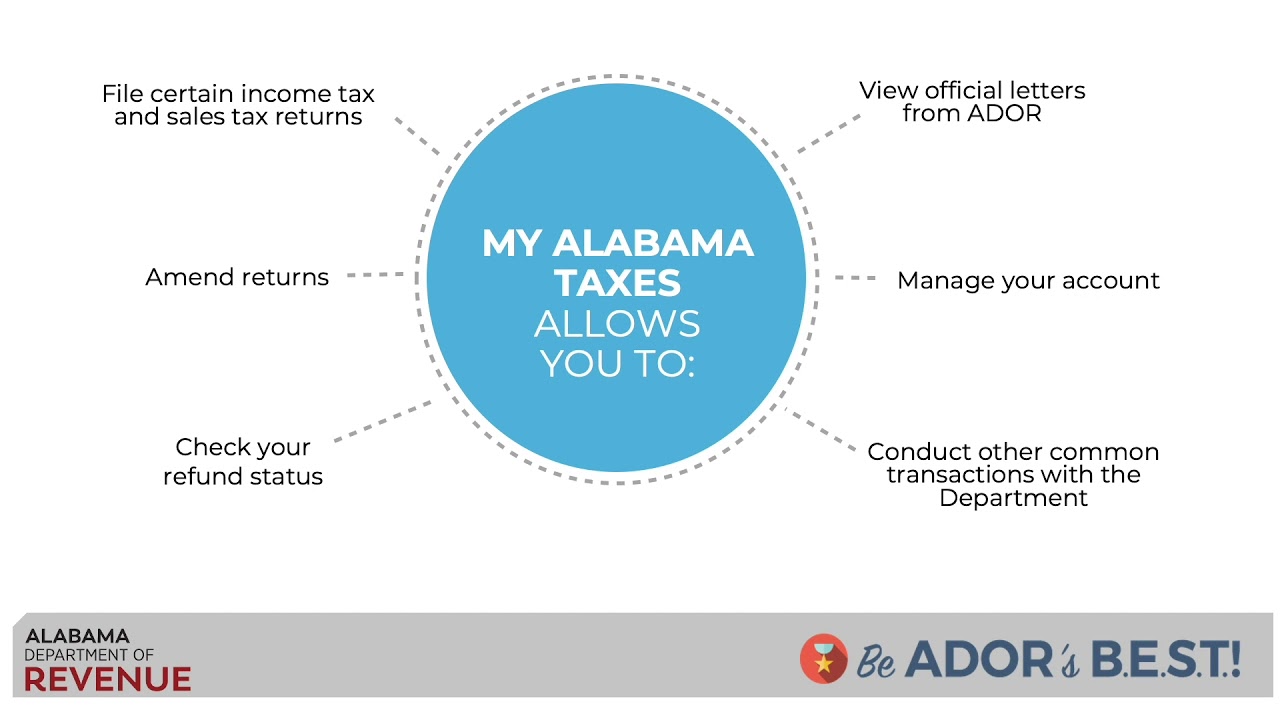

. Instructions for Uploading a File. Since October 1 2013 Alabama retailers have been able to file and pay all citycounty sales use and rental taxes in MAT the ONE SPOT to file. The ability to access Tax related Information such as assessments.

Spear Montgomery County Revenue Commissioner PO. This is the total of state and county sales tax rates. Search Jobs Agendas Minutes Employee Login.

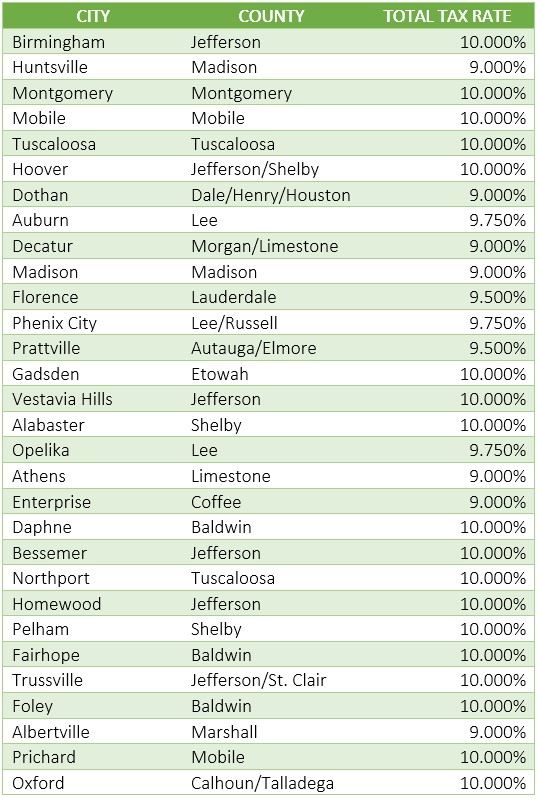

Heres how Montgomery Countys maximum sales tax rate of 10 compares to other. Box 830469 Birmingham AL 35283-0469 ACCOUNT NO. The Montgomery County Alabama sales tax is 650 consisting of 400 Alabama state sales tax and 250 Montgomery County local sales taxesThe local sales tax consists of a 250 county sales tax.

My Alabama Taxes MAT is the states electronic filing and remittance system used for the filing of state city and county sales use rental and lodgings taxes. The ability to pay your Taxes at your convenience 24x7. Montgomery County collects a 25 local.

The minimum combined 2022 sales tax rate for Montgomery County Alabama is. Effective April 1 2008 if you owe 500 or more in taxes you will be required to file the return online and pay the tax online. The current total local sales tax rate in Montgomery County AL is 6500.

A county-wide sales tax rate of 25 is applicable to localities in Montgomery County in addition to the 4 Alabama sales tax. Montgomery County Commission Tax Audit Department P. Effective JUNE 1 2022 please begin remitting sales business tax and business license returns and payments to the remittance address below.

Some cities and local governments in Montgomery County collect additional local sales taxes which can be as high as 35. The most populous zip code in Montgomery County Alabama is 36117. This service is designed to offer you the following.

Taxpayer Bill of Rights. The convenience of paying your taxes from your home work or anywhere that you have access to the internet. In completing the CityCounty Return to filepay Montgomery County.

TOTAL AMOUNT ENCLOSED Make check payable to City of Montgomery This form combines sales and sellersconsumers use tax reporting. What is the sales tax rate in Montgomery Alabama. Sellers UseSales Tax Consumers Use Tax MAIL RETURN WITH REMITTANCE TO.

Box 830469 Birmingham AL 35283-0469 ACCOUNT NO. Effective October 1 2016 those subject to lodgings tax can also now file and. TOTAL AMOUNT ENCLOSED Make check payable to City of Montgomery This form combines sales and sellersconsumers use tax reporting.

Has impacted many state nexus laws and sales tax collection. If you need information for tax rates or returns prior to 712003 please contact our office. The County sales tax rate is.

Pay by E-CHECKCREDIT CARDS is free of charge. The December 2020 total local sales tax rate was also 10000. City of Montgomery License and Revenue Division CO Department RBT3 PO Box 830525 Birmingham AL 35283-0525.

New Business License and Tax Remittance Mailing Address. The December 2020 total local sales tax rate. This is the total of state county and city sales tax rates.

RETURN DUE Monthly filers should file each calendar month on or before the 20th of the following month even if no tax is due. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The minimum combined 2022 sales tax rate for Montgomery Alabama is.

The Montgomery County Sales Tax is 25. However However pursuant to Section 40-23-7 Code of Alabama 1975 you may request quarterly filing status if you have a tax liability of less than 240000 for the preceding calendar year. Box 4779 Montgomery AL 36103-4779 Tax Period and complete lower portion of back side TOTAL AMOUNT ENCLOSED Make check payable to.

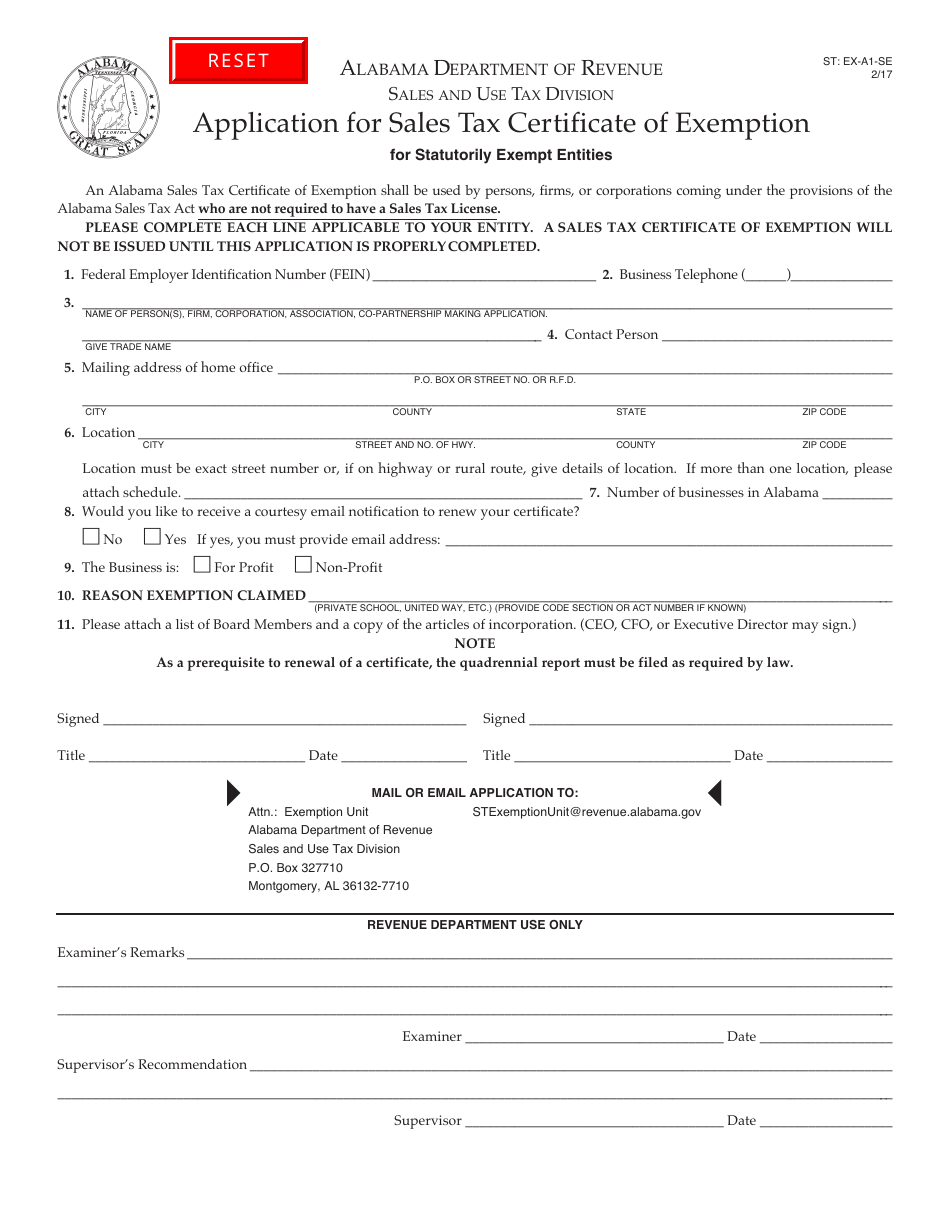

Combined Application for SalesUse Tax Form. Download Or Email DoR 2100 More Fillable Forms Register and Subscribe Now. Montgomery County Alabama Sales Tax Sellers Use Tax Consumers Use Tax Education Only Tax MAIL RETURN WITH REMITTANCE TO.

Montgomery County Alabama Sales Tax Sellers Use Tax Consumers Use Tax Education Only Tax MAIL RETURN WITH REMITTANCE TO. Ad Download Or Email DoR 2100 More Fillable Forms Register and Subscribe Now. Box 4779 Montgomery AL 36103-4779 Tax Period and complete lower portion of back side TOTAL AMOUNT ENCLOSED Make check payable to.

Combined Application for SalesUse Tax Form. Free viewers are required. The Montgomery County sales tax rate is.

Box 4779 - Montgomery AL 36103-4779 Tax Period Check here for any changes in business and complete lower portion of back side. The 10 sales tax rate in Montgomery consists of 4 Alabama state sales tax 25 Montgomery County sales tax and 35 Montgomery tax. The Alabama state sales tax rate is currently.

The December 2020 total local. Montgomery County Commission Tax Audit Department P. Montgomery County AL Sales Tax Rate.

The Montgomery County Sales Tax is collected by the merchant on all qualifying sales made within Montgomery County. The Montgomery County sales tax rate is. Access information and directory of city county and state tax rates for Sales Tax.

The Alabama sales tax rate is currently. RETURN DUE Monthly filers should file each calendar month on or before the 20th of the following month even if no tax is due. Montgomery AL Sales Tax Rate The current total local sales tax rate in Montgomery AL is 10000.

The Montgomery sales tax rate is. RETURN DUE Monthly filers should TAX PAYER ID file each calendar month on or before the. Alabama Department of Revenue.

The one with the highest sales tax rate is 36101 and the one with the lowest sales tax rate is 36036. As far as all cities towns and locations go the place with the highest sales tax rate is Montgomery and the place with the lowest sales tax rate is Grady. Montgomery County AL Home Menu.

The 2018 United States Supreme Court decision in South Dakota v. Sales Use Tax Division.

Alabama Sales Tax Guide For Businesses

Sales And Use Alabama Department Of Revenue

Alabama Severe Weather Sales Tax Holiday 2022 Starts Today What S On The List Al Com

Sales And Use Tax My Alabama Taxes Youtube

Alabama Tax Rates Rankings Alabama Taxes Tax Foundation

Other Alabama Taxpayer Forms Avenu Insights Analytics Taxpayer

Sales Tax Alabama Department Of Revenue

Form St Ex A1 Se Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption For Statutorily Exempt Entities Alabama Templateroller

Alabama Sales Tax Guide For Businesses

Chicago Now Home To The Nation S Highest Sales Tax Sales Tax Tax Chicago

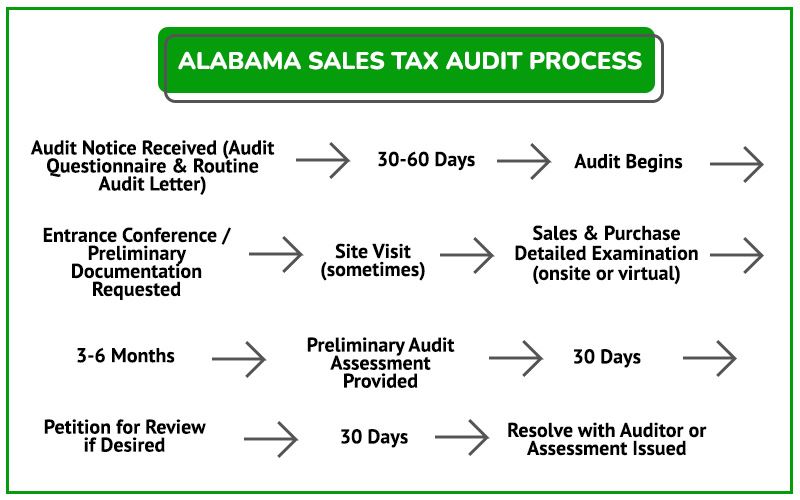

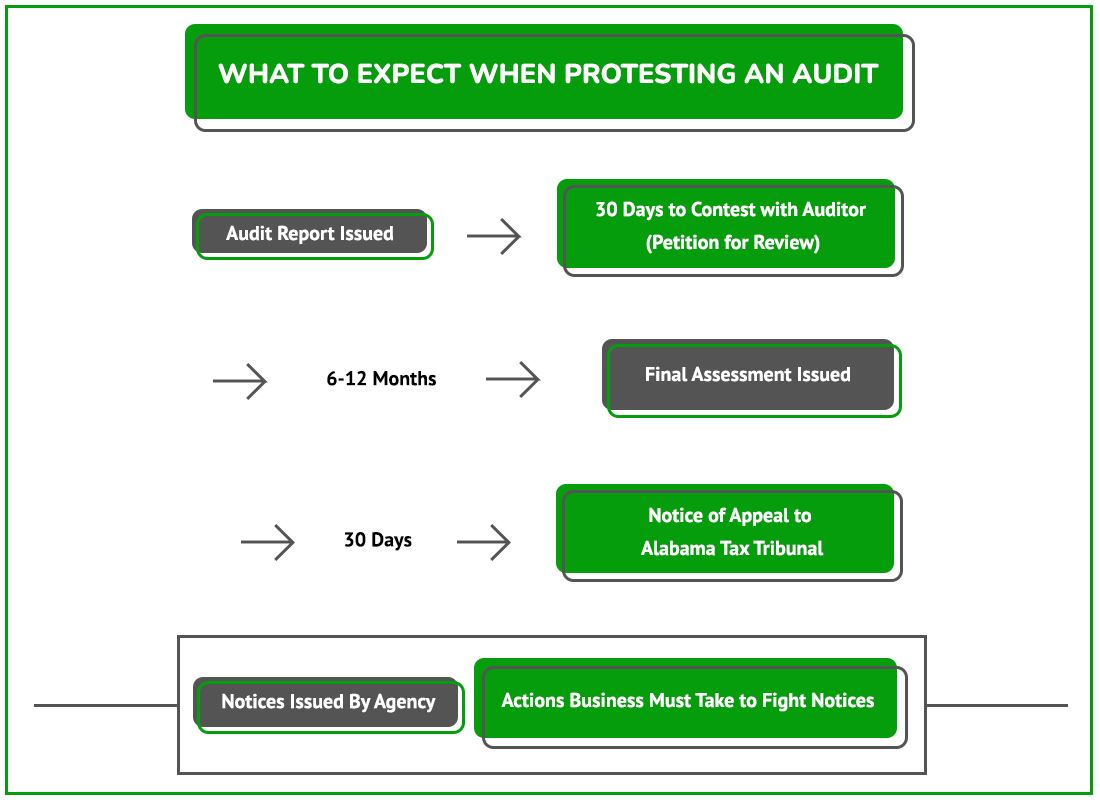

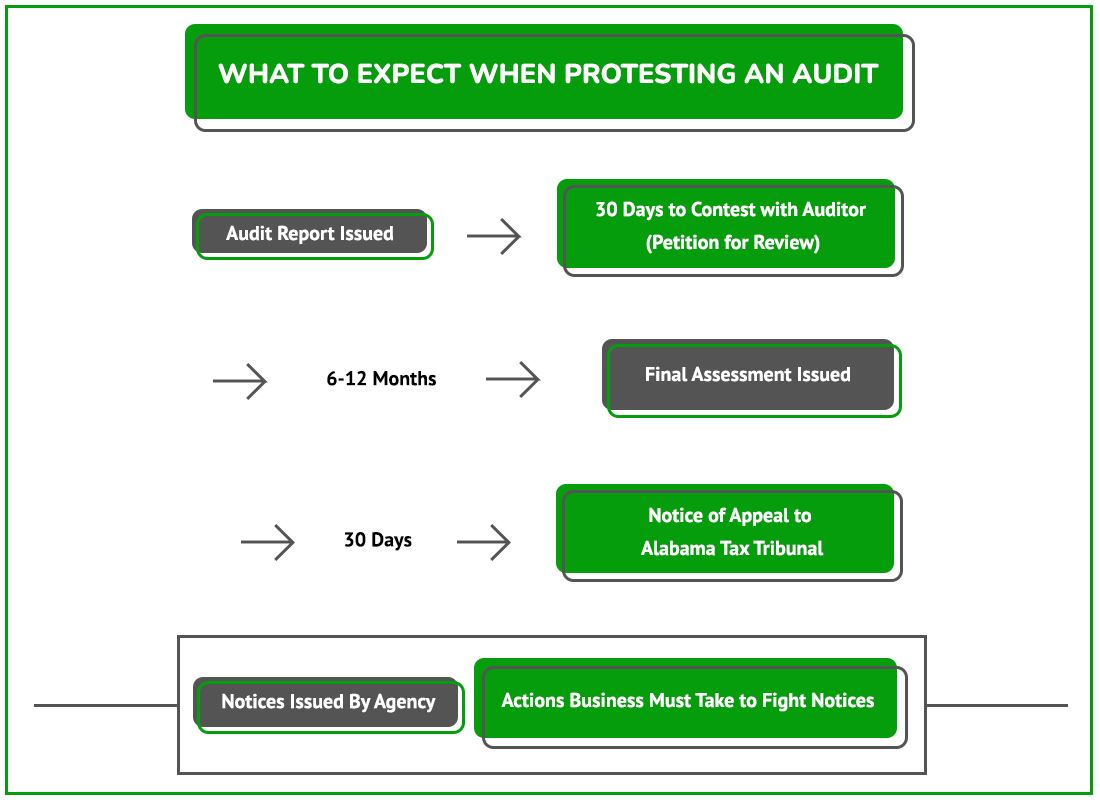

Sales Tax Audit Montgomery County Al